As you go through high school and become an adult, knowing about finances and how to think about them is important.

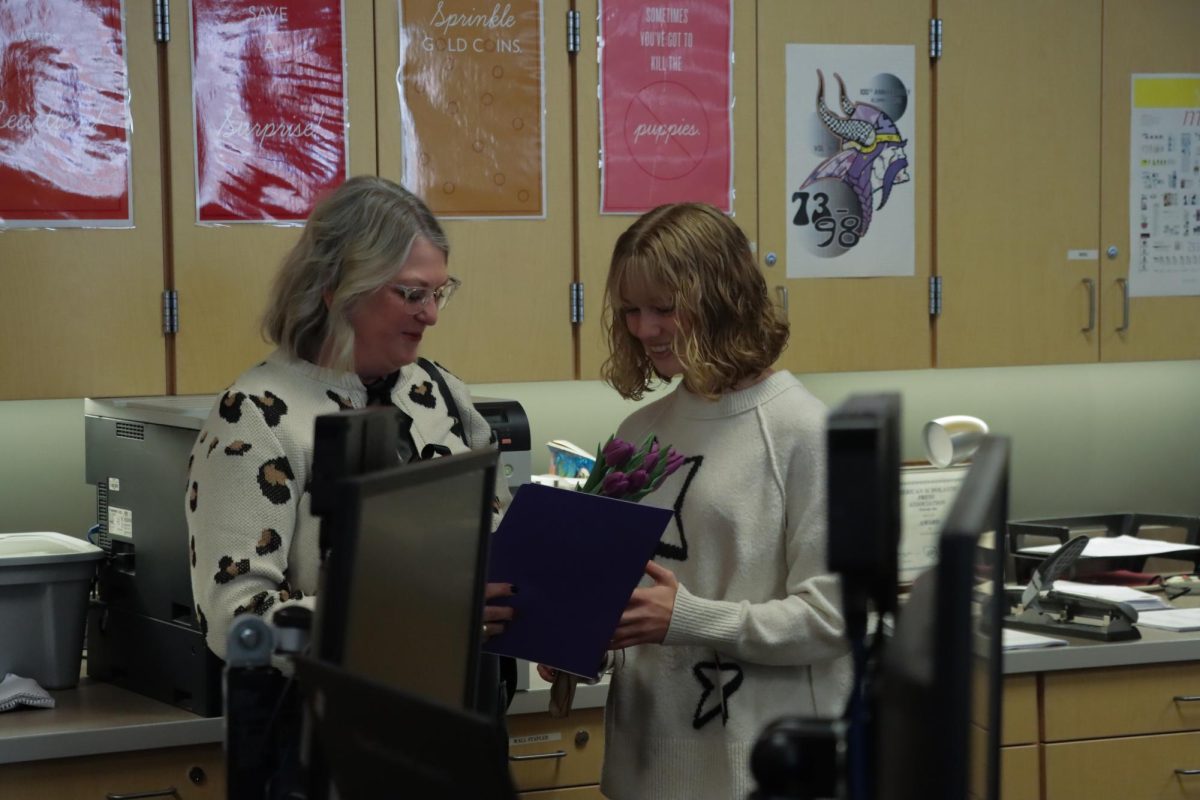

Kim Root teaches Accounting 1 & 2 and says that when going into the corporate world, people will find that all business corporation’s core concern is surrounded by money.

“Accounting is the documentation of the money, other businesses money, its revenue, its expenses, how much money they have, how much they own others and how much people owe them,” Root said. “Accounting is a leader school, so kids that want to go into business and marketing, have classes they have to take before they get into the school of business. [Those classes include] economics, accounting, business, and statistics.”

Root says she loved the aspect of learning and applying money into math. She had her sights set in her high school years.

“Going through high school I thought I wanted to be an accountant, but I also wanted to be a teacher. I like money, I like money math. I don’t necessarily enjoy geometry and higher levels of math. I was fascinated and interested in it. [Money math] is the core language of business,” Root said.

Knowing what skills would make you excel in a class is beneficial. Root says that understanding basic math skills will help.

“Coming into the class with skills like adding, subtracting, and multiplication [will make you more successful in the class]. [Being able to focus but make it an] organized focus,” Root said.

When looking at classes and deciding what specific class to take of the same topic is hard. Knowing what skills, they teach you helps make the choice easier.

“I think you get a better idea of the relationship between money coming in and money going out, revenue and expenses, things like margin,” Root said. “It applies over if you go if you want to buy a house, they have you fill out forms and these forms are really financial statements that show like a balance sheet shows.”

Some misconceptions about going into the accounting is that it means that accountants will be sitting at a desk all day.

“I think people think that either accounting or being an accountant is boring. But counting is more of a constant consultant job where you get information so you can help people make better decisions,” Root said.

You may hear from people that have taken the class before you want to expect, but every year there will be slight changes to the course due to the world evolving.

“Accounting has not changed. Technology has changed a lot. So back in the day, everything would be done on paper. We have pretty much gotten rid of textbooks, and everything is an online textbook and workbook,” Root said.

Knowing how finances work and how to make money last longer is important.

“Long term investing, and how important it is to starts saving money, and how much that money can increase by starting at a younger age,” Root said.

Root’s class can become predictable from day to day.

“Every chapter builds on itself, new units would start with out with our vendor leaves as business you so instead of me having to do a PowerPoint, lecture notes, they have these little like eight-minute section videos,” Root said. “They walk through and do all the demonstration. Then I would go through a new concept with them.”

Being able to earn different types of certifications from classes at the high school level allows students to begin your career right out of high school.

“A lot of small businesses use QuickBooks for their accounting, and my accounting students have the opportunity if they do well on the precertification tests to take a free QuickBooks online certification test,” Root said. “That is something that they could put on their resume, either for employment or maybe if they were at the college level looking at working on their computer lab, that they would have that certification to show that an independent institution certified me in this skill.”

The Puyallup High School’s accounting class offers dual credit, allowing for general elective credits at the community or four-year college level. At the high school Accounting offers occupational credit.

Yesica Pak teaches Financial Literacy. She worked in financing for 15 years. This let her work with people who were struggling financially.

The importance of not only knowing your finances but understanding them as well.

“It’s an important class because it provides students with some valuable skills to navigate the real world. Once they become financially independent, or still living at home, they are able to learn how to budget, how to get a job, how to read their pays stub,” Pak said. “The skills that they’re learning here are skills that like they can immediately apply to the, to their lives.”

Pak says that she enjoys being around the students and teaching them all.

“My favorite part is really the students. The students as a whole have really diverse backgrounds,” Pak said.

The types of skills you would learn in Financial Literacy are like any other finance class.

“How to present yourself to a potential employer, how to read a pay stub, do your taxes, start building credit, investing, and protecting your assets,” Pak said.

This class has less misconceptions about it but more that it is lesser known.

“I think a lot of people don’t know that we teach such a class. I am always super surprised by how much my students teach me about finances in the world that they live in,” Pak said.

As each class changes Pak has had to face that change by incorporating new things into the curriculum

“When I first started teaching, this class Venmo and Cash App was not really a thing. Now we have different ways of submitting payments,” Pak said. “Back in the day, I used to teach students how to write a check. Now, we don’t spend as much time because of technology and social media. The principles are the same, but just how we access our money and how we purchase things has changed a lot.”

Some things that people do not know how their spending now would affect what happens in your future.

“What they’re not aware of is how their current choices affect their future. You know how, even if it’s a small choice, it still has an impact on their future,” Pak said.

Each class period looks a little different every day, Pak tries to include something that will get the students moving every day.

“We do I try to do like a lot of interactive activities. I share a lot of the things that I’ve seen from working in the finance industry,” Pak said.

Each student picks up different things from every class that they take.

“I think that they leave here with the understanding that their choices when it comes to money are important and can have some long lasting like consequences,” Pak said.

Root also teaches Business and Marketing 1, 2, and 3. At PHS the marketing classes are a part of a career pathway.

“We have a three-year marketing program, ideally Marketing 1 is for 10th graders. What I really enjoy about Marketing 1 is if I can get students in as a 10th grader and they really liked the class, they have the opportunity to be in the program for three years,” Root said. “DECA is part of marketing, that’s where we have to integrate community service, career information, competition. Marketing 3 students are in charge of the espresso bar, they purchase the inventory, the training, the financials, the marketing.”

In marketing Root says that students will learn lots of different skills.

“Customer service is number one. Learning how to be a salesperson, how to present yourself, how to provide good customer service. To understand the concepts of functions activities that are necessary for a business to be successful and then have hands on experience,” Root said. “Most of the things that they do in here will transfer to other places of employment, or they might go into places of employment or school with more confidence, just because they’ve already worked with a team.”

Root enjoys being the adviser for the DECA program here at PHS.

“It probably always comes down to competition. Competition sounds weird, but in DECA competitions are really like a business meeting, or doing a sales pitch or a sales presentation,” Root said. “When students prepare their preparing to either go stand or sit with a judge and answer or solve a problem.”

Root’s philosophy is that everything is a business and that everything you learn comes back to being a part of a business.

“This is where students can take all their classes and they can put their skills to use. I think sometimes people don’t think it’s challenging enough, and that there’s better opportunities that students could take,” Root said.

Root teaches the value of the dollar and why things like water cost money.

“So, we’re able to look at things like how much does it costs to make something? How much are we selling it for? The margin is the difference in between. So, if you put something on sale, does it make the margin go up or down?” Root said. “Think its attention to detail. And just looking at how important each thing is, I mean, if we make a shirt and we mess up on it, and we’re quoting orders to people, we must factor in a couple of mess ups, or we’re always going to lose money.”

Root likes to see the progression of having students in the marketing program throughout the three years.

“I like the progression of where it goes from [marketing] one to three. It feels pretty cool, when you can sit back and get to fourth period during the day, or if I can be out if I’m out sick and I can write a note to my substitute that says, ‘hey, they got it. Just sit back, watch, and enjoy.’ And the whole class can just do everything. That’s a proud moment for me,” Root said.

The things that students will take out of the marketing class varies between students but overall, they take away three main things.

“I think they take away confidence, customer service, and just that this was our home you know,” Root said. “They have a job to do. They have other students that rely on them, even if it’s not during class time. They want to be here for one another.” U